The Hecks Embrace Frugality in “The Middle”

In the charming universe of “The Middle,” the Heck family faces the ups and downs of life with humor and tenacity. This time, as financial pressures mount, Frankie, Sue, and Brick must adapt to a more frugal lifestyle. Join us as we explore their latest adventures in budgeting and discover how they tackle these challenges with their trademark wit.

Navigating Financial Challenges: The Heck Family’s Budgeting Journey

As financial constraints tighten around them, the Hecks embark on a journey to manage their budget effectively. Faced with limited resources, they learn to prioritize spending wisely while embracing frugality as a guiding principle. In this episode, viewers witness how tough decisions become essential for maintaining stability.

The Hecks employ innovative strategies to maximize every dollar spent. Through careful planning and smart choices, they uncover opportunities that allow them to stretch their finances further than expected. Their resilience shines through as they demonstrate that unity and determination can overcome even the toughest economic hurdles.

Creative Frugality Strategies: How the Hecks Make Ends Meet

In this latest installment of “The Middle,” Sue takes on her role as an eternal optimist by devising clever ways to make every cent count—from coupon clipping to engaging in DIY projects. The family’s commitment to frugality tests their creativity in unexpected ways.

Meanwhile, Frankie steps up her game by transforming budgeting into an art form. With her keen eye for savings and knack for spotting deals, she guides her family through uncertain financial waters. Together, they turn challenges into opportunities for growth while reinforcing familial bonds through shared sacrifices.

Strategies for Resilience: Embracing Thriftiness

Amidst ongoing financial struggles, the Heck family showcases remarkable resourcefulness when faced with tight budgets. They embody resilience by making strategic decisions that emphasize doing more with less—an approach that becomes crucial during tough times.

Their journey highlights how innovative solutions can lead to impactful yet economical choices that secure financial stability even amidst adversity.

Economic Pressures: Insights from “The Middle”

Within “The Middle,” where economic pressures loom large over daily life, the Hecks navigate challenging circumstances requiring them to embrace frugal living like never before.

This journey involves creative solutions such as thrift store finds or home-cooked meals prepared together—a testament to each member’s contribution toward achieving financial balance while discovering valuable lessons about resourcefulness along the way.

Conclusion

“The Middle | The Hecks Have To Get Frugal When Money Gets Tight” offers an engaging look at how families can face economic challenges head-on while maintaining humor throughout difficult times—showcasing not just survival but thriving against all odds!

Frugal Fun: How the Hecks Turn Financial Struggles into Family Adventures in ‘The Middle’

Meta Title

Frugal Fun: The Hecks’ Journey through Financial Challenges in ‘The Middle’

Meta Description

Explore how the Hecks in ‘The Middle’ transform financial challenges into memorable family adventures through frugality and creativity.

Understanding the Hecks’ Financial Challenges

The Reality of a Tight Budget

In the charming sitcom ‘The Middle,’ the Hecks often find themselves facing financial challenges. They epitomize the struggles of many middle-class families, juggling bills and budgets while trying to maintain a semblance of normalcy.

- Bills vs. Income: The Hecks frequently illustrate the conflict between limited income and mounting expenses.

- Rising Costs: From healthcare to school supplies, the Hecks navigate the same increasing costs that many families experience today.

The Impact of Financial Strain on Family Dynamics

Financial struggles can put a strain on relationships and family dynamics, however, the Hecks manage to keep the mood light. They exemplify resilience, turning potential conflict into opportunities for bonding.

- Communication is Key: Discussing money matters openly can lead to shared solutions and a unified approach.

- Shared Goals: Setting family goals, even during tough times, can enhance cooperation and support.

Practical Tips for Embracing Frugality

Tips from the Hecks

The Hecks may be fictional, but their methods of tackling frugality are practical and applicable in real life. Here are some strategies inspired by their journey:

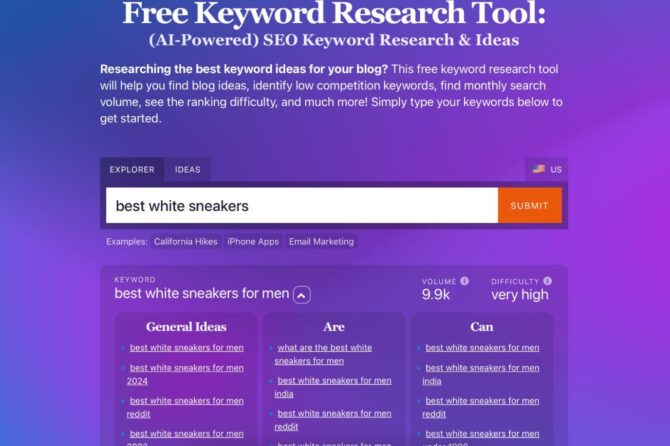

- Create a Family Budget

- Track all income and expenses to understand where money is going.

– Use tools like budgeting apps or simple spreadsheets to visualize savings.

- Embrace Thrifty Living

– Find bargains in thrift stores or garage sales, just like Frankie Heck does when hunting for household items.

– Explore community events that offer free activities or entertainment.

- Involve the Whole Family

– Get everyone on board with money-saving challenges—like a no-spend week.

– Have fun cooking together using pantry staples to create delicious meals.

Fun Family Activities on a Budget

Engaging family activities don’t have to be expensive. Here are some fun ideas:

- Game Night: Pull out board games or create your own trivia based on family experiences.

- Outdoor Activities: Take advantage of local parks or trails for family walks or picnics.

- DIY Projects: Get crafty with projects that involve upcycling old items into something new.

Benefits of Frugal Living

Strengthening Family Bonds

In times of financial difficulty, families often come together, recognizing the importance of support and teamwork.

- Shared Experiences: The Hecks’ shared challenges foster deeper understanding and camaraderie.

- Creative Problem Solving: Working together in tough situations enhances collective creativity.

Financial Literacy Skills

The Hecks’ frugality teaches important life lessons on managing money.

- Understanding Value: Learning the difference between needs and wants can help shape spending habits.

- Strategic Planning: Creating a plan for expenses can prepare families for future financial challenges.

Case Studies: Real Families, Real Solutions

Family A: The Johnsons

The Johnsons found themselves in a similar situation as the Hecks. By implementing a simple family budget, they reduced monthly expenses by 30%.

- Outcome: They streamlined grocery shopping by meal planning and utilizing local farmers’ markets for fresh produce.

Family B: The Smiths

The Smiths engaged in family activities that didn’t break the bank—focusing on nature hikes and community events.

- Outcome: They discovered local parks they never knew existed, bonding over new adventures and experiences.

Practical Frugal Tips for Parents

Save on School Supplies

- Look for Sales: Keep an eye on summer sales for school supplies well ahead of time.

- Buy in Bulk: Team up with other parents for bulk purchases to save more.

Save on Household Items

- DIY Alternatives: Create cleaning supplies using household ingredients like vinegar and baking soda.

- Online Marketplaces: Check local listings for second-hand furniture or appliances before buying new.

Conclusion

By navigating financial struggles with creativity and resilience, the Hecks provide valuable lessons on thriftiness. Their ability to transform challenging situations into engaging family adventures offers a refreshing perspective for anyone facing similar difficulties. Embrace the frugal fun and let these experiences strengthen both family bonds and financial wisdom.

HTML Table: Quick Tips for Frugal Living

| Tip | Description | Benefits |

|---|---|---|

| Create a Budget | Track your income and expenses. | Awareness of spending helps save money. |

| Thrift Store Finds | Shop for used items and second-hand goods. | Unique items at a fraction of the cost. |

| Family Cooking | Cook meals together using pantry staples. | Quality time spent while saving on dining out. |

By implementing these engaging strategies and embodying the frugal spirit of the Hecks, families can navigate financial challenges while creating cherished memories.